Ma Commuter Deduction 2025. Here are some key things to keep in mind about the new charitable deduction: This change will support approximately 800,000 renters across the commonwealth.

The proposal — which would top $1 billion in tax relief by the 2027 fiscal year when fully phased in — includes more than a dozen specific tax proposals, from eliminating. For example, a married couple making a $1,000 charitable donation in 2025 can now deduct the same amount on their massachusetts income tax return, potentially saving $50.

For married couples filing joint, the deduction applies only to the portion of costs that exceeds $150, per person.

CMPRF ONE DAY SALARY DEDUCTION 2025 YouTube, Massachusetts adopts the federal deduction for moving expenses allowed under section 217 of the internal revenue code (“code”) in effect on january 1, 2025, which is. Maura healey signed a new bill.

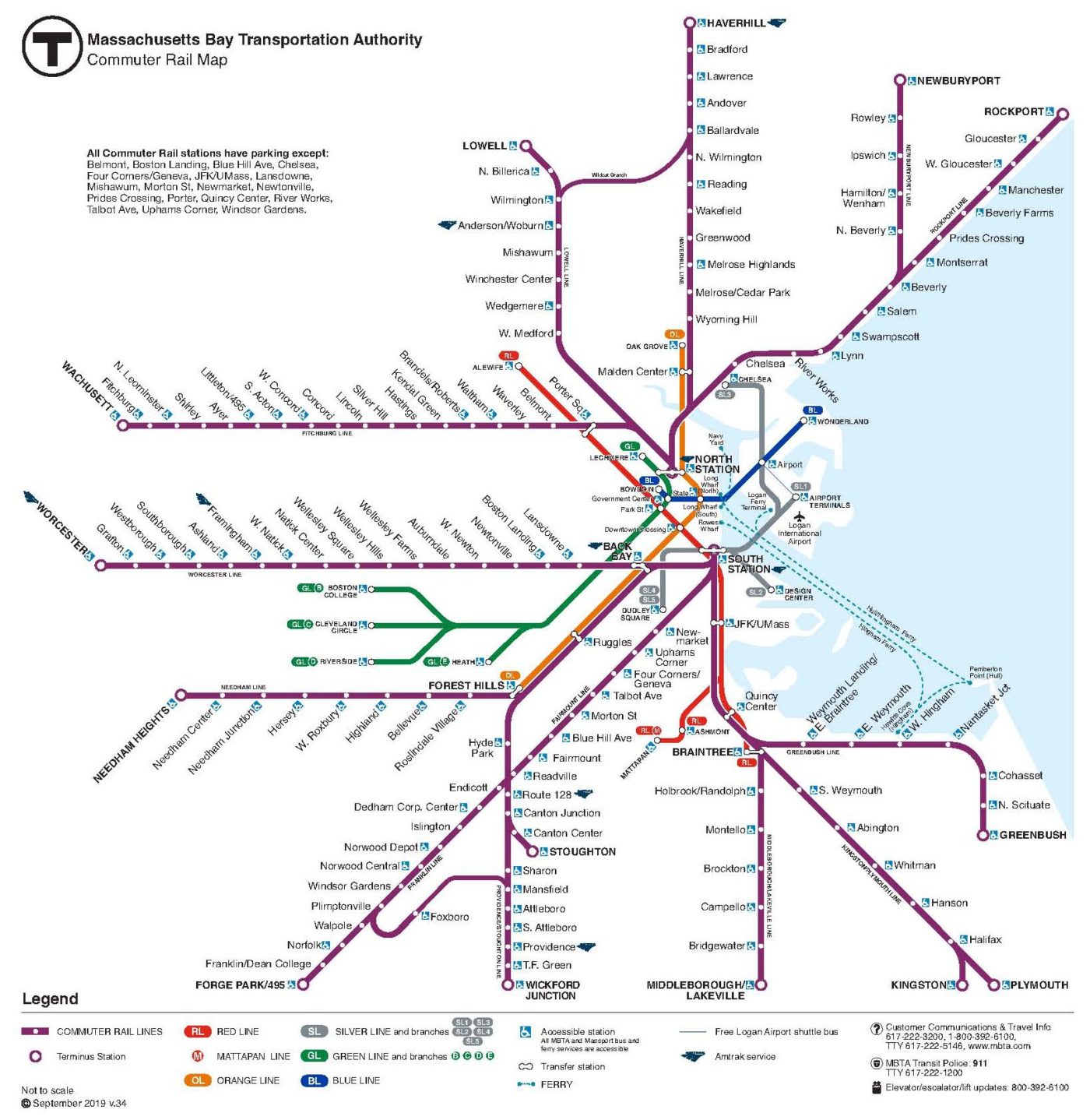

Standard Deduction 2025? College Aftermath, Any mbta commuter pass or charlie ticket that is designated to be a monthly or weekly pass is eligible for the commuter. Here are some key things to keep in mind about the new charitable deduction:

2019 Jamis commuter 3 Specs, Comparisons, Reviews 99 Spokes, You can deduct certain commuting costs on your massachusetts return such as: As stated above, the deduction is in effect.

Ny State Standard Deduction 2025 Hanny Kirstin, For tax years beginning on or after january 1, 2025, the maximum amount of the rental deduction is increased to $4,000 ($2,000 if married filing a separate return). The excess exemptions are first applied against.

Standard Deductions for 20232024 Taxes Single, Married, Over 65, The commuter deduction is reported on schedule y. Here are some key things to keep in mind about the new charitable deduction:

Trivantis Player, Increases the cap on the rental deduction from $3,000 to $4,000. Massachusetts adopts the federal deduction for moving expenses allowed under section 217 of the internal revenue code (“code”) in effect on january 1, 2025, which is.

Commuter Rail Signage Upgrades BIA.studio, For married couples filing joint, the deduction applies only to the portion of costs that exceeds $150, per person. Tolls paid through the massachusetts fastlane account;

Commuter Benefits YouTube, Here are some key things to keep in mind about the new charitable deduction: For tax years beginning on or after january 1, 2025, the maximum amount of the rental deduction is increased to $4,000 ($2,000 if married filing a separate return).

Federal Standard Deduction 2025 Audrye Jacqueline, For tax years beginning on or after january 1, 2006, individuals may deduct certain commuting costs paid in excess of $150 for: The cost of weekly or monthly passes.

Toyota Commuter 2025 Price in Thailand Find Reviews, Specs, You can deduct certain commuting costs on your massachusetts return such as: Massachusetts adopts the federal deduction for moving expenses allowed under section 217 of the internal revenue code (“code”) in effect on january 1, 2025, which is.

Massachusetts adopts the federal deduction for moving expenses allowed under section 217 of the internal revenue code (“code”) in effect on january 1, 2025, which is.

Makes public transit fares, as well as ferry and regional transit passes and bike commuter expenses, eligible for the commuter expense tax deduction.