Texas Property Tax Relief 2025. Fort worth’s proposed 2025 budget is nearly $2.6 billion. In july 2025, abbott signed into law an $18 billion property tax relief packag e for texas homeowners, the property tax relief act.

John cornyn of texas, a longtime gop tax writer,. Property tax bills flyer (pdf) tax assessors prepare and mail bills to property.

Tax Relief Free of Charge Creative Commons Financial 3 image, The property tax exemptions apply to owners or operators of child care facilities that participate in the texas rising star program. The bill provides for $12.7 billion in tax relief for property owners through four main avenues:

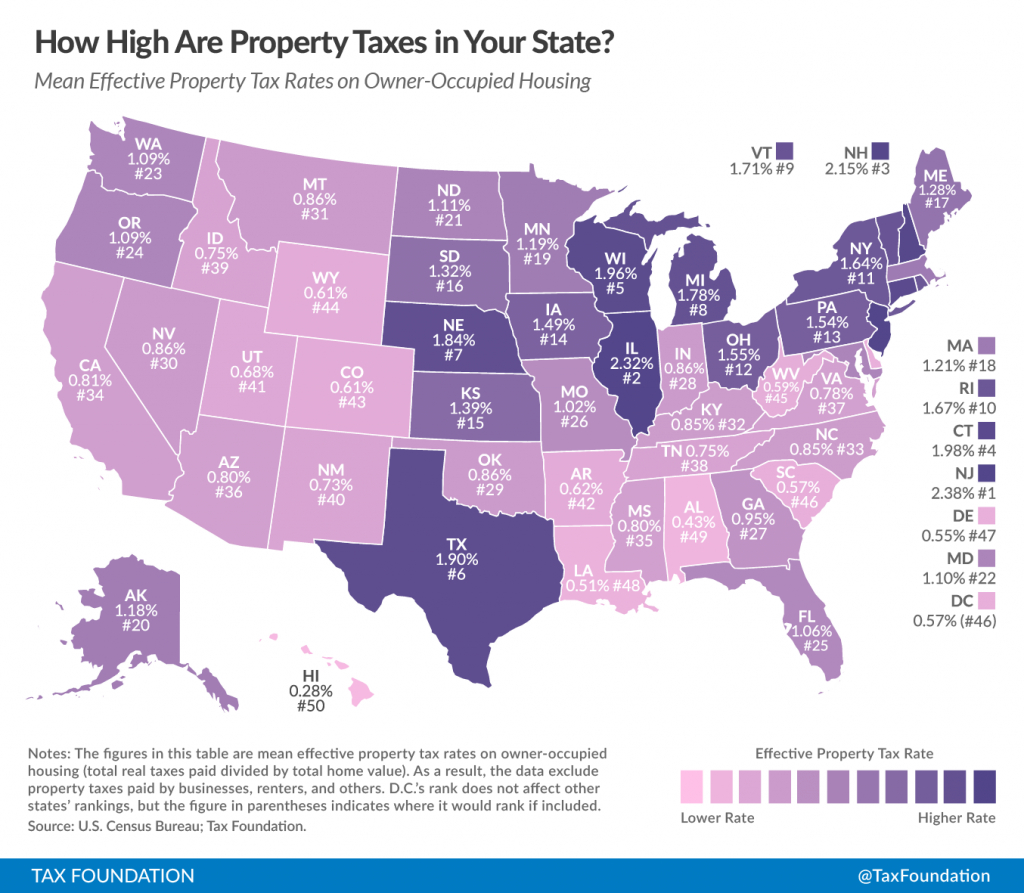

How High Are Property Taxes In Your State? Tax Foundation Texas, The texas house has approved a $17 billion proposal that would provide property tax relief to homeowners and businesses across the state. Texas legislature passes record $18 billion property tax relief package | texas standard.

Texas property tax relief plan Here's who would benefit, The bill provides for $12.7 billion in tax relief for property owners through four main avenues: The property tax exemptions apply to owners or operators of child care facilities that participate in the texas rising star program.

Texas House Passes Property Tax Rebate Texas Scorecard, August 9, 2025 | austin, texas | press release. Greg abbott signed an $18 billion property tax relief plan into law after months of deliberation between republican leaders during a second special.

What the approved Texas property tax relief plan means for you, Texas homeowners and businesses will get potentially thousands of dollars cut from their property tax bills in the coming years after voters tuesday overwhelmingly approved. A deal on property tax relief was reached during the second special session with two bills and a joint resolution signed into law by gov.

Ten Ways to Protect Property Tax Relief in 2025, Delinquency dates, penalty and interest by type of property tax bill. Texas homeowners and businesses will get potentially thousands of dollars cut from their property tax bills in the coming years after voters tuesday overwhelmingly approved.

Texas property tax relief Your questions, answered, A $12.7 billion package of property tax cuts goes before voters later this year, promising to deliver savings to millions of property owners in texas suffering from. The new law passed with 83% of the vote in november,.

Oil Falls More Than 2 As Investors Weigh Recession Risk Infooaccountancy, This includes business entities whose tax returns and payments are due march 15th. The texas house has approved a $17 billion proposal that would provide property tax relief to homeowners and businesses across the state.

Texas Property Tax Relief What You’ve Heard and What You Haven’t, The 2025 tax bills which due at the end of the month, so here are. In july 2025, abbott signed into law an $18 billion property tax relief package for texas homeowners.

Small business get tax relief in Texas Property Tax Reform C. Brian, The package puts $12.6 billion of the state’s historic budget surplus toward making cuts to school taxes for all property owners, dropping property taxes an average of more than. Texas continues to enjoy strong revenue growth, and reducing the.

Texas homeowners and businesses will get potentially thousands of dollars cut from their property tax bills in the coming years after voters tuesday overwhelmingly approved.